After the Wars, TARP stood as Bush's Last Stand

Sunday, February 27, 2011

1 Response

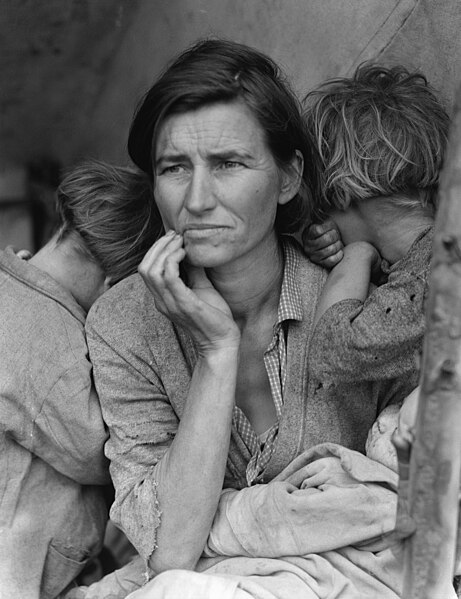

Migrant Mother during the Great Depression |

As President Bush stated during a 2008 Ann Curry NBC Today Show interview, “The Iraq and Afghanistan wars caused a boost to the economy.” Well initially it did -- this was the case in Washington, DC with rising expenditures in the Pentagon and defense contractors. But today, with the Obama Administration sharply cutting back on federal spending, that economic boost spurred by the government is finally tapering off.

How Much Did the Wars Cost?

During a double-digit recession, the wars, which is now the second-most expensive in US history after WW II, have become a huge drain for an economy that is hurting for dollars. The fiscal burden of war is not just to execute to win but also to sustain the fight during the occupation stage. Additionally, American taxpayers will have to pay for the cost of the war throughout their life times, since there are many injured troops who have sustained lifelong disabilities and mental trauma. Furthermore, the huge cost of military spending has worsened the deficit ($1.5 trillion) requiring the government to make immediate and steep budget cuts, which the GOP-led House is now championing. Ironically, the GOP is fairly reticent in reminding Americans that it was President Bush's wars and tax cuts that led to this deficit (Brookings Institute)

Housing Crisis was the Trigger

But did the War lead us into a double-digit recession? Despite the $2 trillion plus spent so far, it is merely just 1% of our GDP. It was instead the housing crisis that caused the US and other parts of the world to slip into a recession. Any good economist as early as 2005, could tell that the steep rise in the price of housing followed by the stock market bubble in the 90s was leading to a bubble that would eventually lead to severe consequences for our economy.

Was Bush to Blame?

So was the Bush administration to blame? In my research on my previous paper on Frank Dodds, I was surprised to learn that it was the Bush administration (known for its support of deregulation) who wanted to keep tabs on both Freddie and Fannie.

Bush Wanted Oversight of Fannie/Freddie

In 2005, President Bush (and also Sen McCain) wanted to transfer oversight of Fannie and Freddie to the HUD. After the accounting scandals that hit Enron, WorldCom and others, this seemed like a good idea. President Bush did not feel that Congress could do its job in overseeing Fannie and Freddie, who had issued over $1.5 trillion in outstanding debt.

Democrats Oppose Transfer

But Rep Barney Franks, the ranking Democrat in the Financial Services Committee, strongly opposed this bill. This clear act of partisanship turned out to be a huge mistake, because reining in Fannie and Freddie and preventing them from investing in risky securities could have significantly alleviated the housing crisis.

"These two entities—Fannie Mae and Freddie Mac—are not facing any kind of financial crisis," said Representative Barney Frank of Massachusetts, the ranking Democrat on the Financial Services Committee. "The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing." Rep Frank

The Fiascos of Fannie and Freddie

Financial giants such as Freddie Mac and Fannie Mae with the government asleep at the switch, played in intricate role in the leveraging of the sub-prime market. The Bush administration felt that Fannie and Freddie were cooking their books so Treasury Secretary John Snow proposed placing the companies under the Treasury oversight with strict controls over risk and capital.

Even if the Bush administration was successful in transferring oversight of Freddie and Fannie to the HUD, the housing crisis would likely not have been completely averted. However, it is possible that the HUD would have found the subprime market problematic and sounded alarm bells sooner which could have possibly significantly lessened the impact.

Nevertheless, the Bush administration with the backing of the Federal Reserve, failed to convince Congress to transfer oversight until it was way too late. During this time, interest rates stayed abnormally low, making it cheaper for consumers to buy houses. After origination, mortgages were then repackaged and sold as securities such as Collateralized Debt Obligations (CDO). And when they ran out of borrowers, they mortgage industry found a way to make sub-prime loans to people who couldn't afford them.

Were Americans at Fault?

The mortgage crisis began in 2007 after a sharp rise in mortgage delinquencies and foreclosures. About 80% of the mortgages issued from around 2005--2007 were adjustable-rate mortgages (I know, I was issued a couple of them from refinances on a few of my rental properties in SE DC which I used mainly for repairs and renovation. In many ways, I and my borrowing habits contributed to the Housing crisis.

Some may argue that the American public should have stayed on its toes and applied some pressure on these companies to stop such risky investment. But lets face it, middle class America was able to purchase homes that they would have never dreamed of buying in the past, and the average person would assume that these large banking and investment firms would have been reasonable and not have invested more money than they could risk in investments that were very risky. The books should have all balanced out. Liabilities should never have been greater than assets but greed and mismanagement got the best of them.

Money Could Have Have Stamped out World Hunger

But despite the fact, that the wars did not cause the recession, with the myriad of problems we are facing today, it was not a prudent way to spend money. That $2 to $3 trillion dollars could have been better spent providing healthcare to the uninsured, feeding the poor, stamping out illiteracy around the world, etc. In addition there were second-tiered effects since our indebtedness from the wars contributed to disastrous monetary policy and regulations which favored low interest rates spurring the real estate bubble. Because of the burgeoning costs of both wars (which far superseded earlier projections of only $100 to 200 billion), the Federal Reserve flooded the American economy with cheap credit to help pay for it. Quite frankly, without the burden of managing two wars, our government could have focused on our economy and reacted sooner and more comprehensively.

"The regulators were looking the other way and money was being lent to anybody this side of a life-support system."

Professor Joseph Stiglitz, a Nobel prize winning economist at the Columbia Business School and a former economic adviser to President Clinton.

By, 2008, with our economy on the brink of collapse, President Bush had one last chance to keep our country from slipping into a depression. From 9/11 to Katrina, Bush’s eight-years in office was full of turmoil and catastrophe – would there be one more that would eclipse the Great Depression of the 1930’s? Amazingly, President Bush rose to the challenge, quickly gaining bipartisan support and decisively bailing out the Automotive Industry, the Banking Industry, the Housing Industry and many others.

Congress authorized $700 billion for the Troubled Asset Relief Program (TARP) which by itself added 3.4 percent to the GDP and added almost 2.7 million jobs. With this money, Congress purchased distressed assets, especially mortgage-backed securities, and made capital injections to banks.

Chairman Ben Bernake warned Bush sternly that if he didn’t act fast, our country would slip into another Great Depression. Secretary Paulson said that “We may not have an economy on Monday.” Despite all the past missteps, the government’s action during this very critical and dire time in history was far reaching and just the right intervention that rescued our economy from falling off a cliff.

Today, not only have the majority of the loans been paid off, the government is actually starting to make money. The government proved its mettle during the most difficult time in Bush’s administration. It proved that government intervention (as opposed to Laissez Faire) does work. Ironically, the government performed well as a bank and got paid back a lot sooner and more completely than expected with more government money.

With the world financial crisis (US, Greece, Dubai, Ireland, etc.), these scenarios prove that John Maynard Keynes may have been right all along – that government intervention during times of economic turmoil” is exactly what’s needed. Keynes also argued that the private sector can be inefficient and that the public sector needs to be more responsive.

Thus a key public policy recommendation is more government regulation (However, with the budget deficit, this would have to be conducted with less government).

It was faulty public policy of deregulation and home ownership that led to the financial crisis. Thus the public policy should have been given greater oversight of Fannie and Freddie and the Housing Market. Ironically, in 2005, President Bush wanted to transfer oversight of Fannie and Freddie to the HUD, after accounting scandals had hit Enron, Worldcom and many others. Sadly, Rep Barney Franks and the Financial Services Committee stuck with party lines and opposed this proposal.

It was also the federal government’s public policy (both Republicans and Democrats) that promoted home ownership through FHA and allowing buyers to purchase homes with the smallest down payment possible. Sadly, Fannie and Freddie had enormous lobbying powers and were able to influence Congress who didn’t want to vote against Congress.

This policy for increased home ownership was devastating to our economy and was a huge factor that led to the financial crisis.

Today, the housing market in some areas have stabilized thanks to improving public policy in this area. Additionally, home owners who were able to modify their loans were able to receive an average of 36 percent reduction in their mortgage payments.

With TARP, the government performed well as a bank and got paid back a lot sooner and more completely than expected (with more government money). In addition, unemployment has come down (although slightly). Since the government bailed out the banks, the government is relying on them to spur the economic recovery. The government (Secretary Geithner) is pushing for a more liberal monetary policy so that banks can lend more to individuals as well as businesses. Sadly, many banks (who are flush with cash) are still lending very little of its bailout funds – this needs to change in order for the economy to recover more quickly.

The government proved its mettle during the most difficult time in Bush’s administration. It proved that government intervention (as opposed to Laissez Faire) does work and both the government and the private sector needs to work side-by-side. Today as borrowing costs have come down, larger businesses have raised substantial capital from private sources. Now the government should continue pushing hard for the small businesses (which hires half of American workers and is thus crucial for economic recovery) to tap government money. In doing so, the government can provide incentives to banks who cater to small businesses. This can be done under the umbrella of TARP. So even with the past success, TARP can be leveraged towards creating jobs and even cutting the deficit.

Read more...